Donating to Incarnation allows us to work together to support ministries that extend beyond the walls of a physical church building. In addition to Incarnation’s general operating fund, additional opportunities are provided to give financially to several ministry partners both within the community and globally.

Incarnation is so very grateful for your generosity! There are a number of methods to make a financial donation; select the method that is easiest for you!

In Person

Offering baskets are available during weekly in-person worship services where you may place your gift. Offering envelopes are available to place your donation in. If you would like to receive personalized offering envelopes for on-going use, email Amy Faymoville, Gifts Manager or call at 651-560-7056 to be added to the list that Incarnation provides to the envelope printer.

By Mail

You may send a check to Incarnation via the US Postal Service at the following address:

4880 Hodgson Road, Shoreview, MN 55126

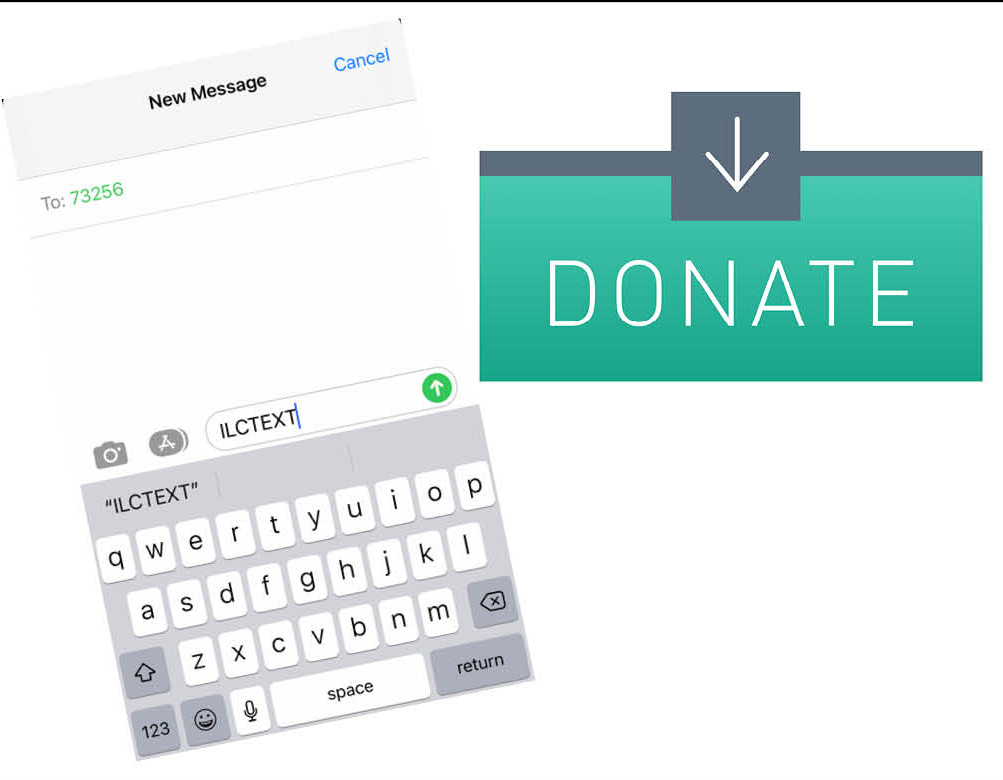

By Text

Giving through texting is easy and secure. Simply text ILCTEXT to 73256 and follow the link to complete the process to donate.

Online

Make a one-time donation or set up recurring donations

Use Incarnation’s online giving form to give to various ministry funds at Incarnation. You select the frequency and date to make your secure donation.

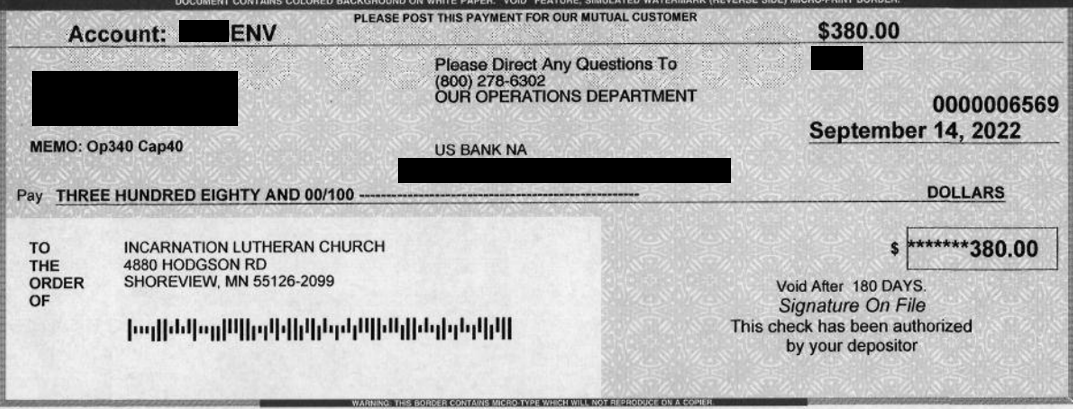

Bill Pay

Many financial institutions offer a way for their customers to set up one-time or recurring payments to vendors and organizations. Contact them directly to inquire if this service is available and/or if there are any fees involved. After setting this up, your financial institution will mail a physical check to Incarnation based on the amount and frequency that you determine.

Stock Donations

When donating stock, you determine the Fair Market Value of your donation based on the average of the highest and lowest price on the date the stock is transferred to Incarnation. Incarnation then resells the stock and applies the money to your pledge or whatever fund(s) you would like the money allocated to. Below is the information that your broker or financial management company will need to know to make the transfer to Incarnation’s Stock account:

Fidelity Investments Account #: Z50542458 DTC #: 0226

Complete this form click here to notify Amy Faymoville, Gifts Manager about your stock donation.

IRA Distributions

Beginning at age 70½, you may be eligible to make a withdrawal as a Qualified Charitable Donation (QCD). A QCD is a direct transfer of funds from your IRA, payable directly to a qualified charity, as described in the QCD provision in the Internal Revenue Code. Amounts distributed as a QCD can be counted toward satisfying your RMD for the year, up to $100,000.

After you reach age 72, you are generally required by federal tax law to withdraw a minimum amount from many types of IRAs; this includes traditional IRAs, rollover IRAs, SEP IRAs, SIMPLE IRAs, and most 401(k) or 403(b) plans each year. These withdrawals are called Required Minimum Distributions (RMDs). If you need to make a Required Minimum Distribution (RMD) withdrawal each calendar year, you may want to consider donating to Incarnation via a distribution from your retirement account.

There are often tax benefits by donating via either of these methods. Please consult your professional tax advisor for more information due to changing tax laws. At this time, physical checks are preferred versus an electronic transfer, so that Incarnation can link the gift to the donor and update your giving record to apply the donation towards any financial pledges that you may have made.

Donor Advised Funds

Giving a grant via a Donor Advised Fund (DAF) is another option to financially support the ministries at Incarnation. Please consult with your financial adviser to determine if establishing a donor advised fund is a beneficial method for you to donate to charitable organizations.

Questions about Giving? Contact Gifts Manager, Amy Faymoville, at afaymoville@incarnationmn.org.